Copper Wire Market Research

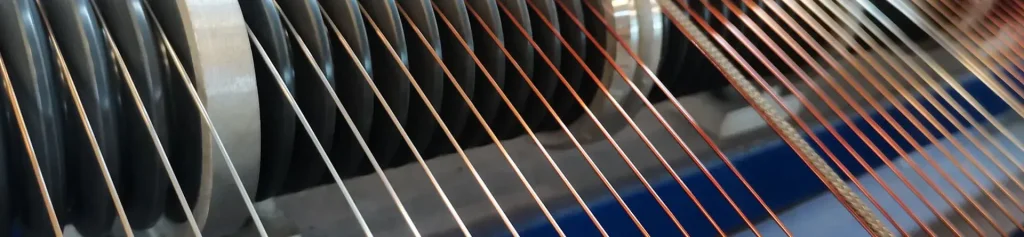

Copper wire is widely used in homes, commercial areas, buildings and industrial power lines. Stranded copper wire, which is widely used in electrical applications, consists of many small wires tied together to form a larger conductor. Stranded wire consists of many small wires tied or wound together to form a larger conductor. Stranded wire is more flexible than solid wire with the same total cross-sectional area. Stranded wire tends to be a better conductor than solid wire because the individual wires collectively contain a greater surface area. Stranded wire is used when higher metal fatigue resistance is required. Copper stranded wire is flexible and has higher fatigue resistance than solid copper wire with the same cross-sectional area. Copper stranded wire consists of multiple small copper wires wound together to form a larger copper conductor. The copper strand market is segmented on the basis of geometry, end-user industry, and geographic location. In terms of geometry, the market is divided into bundles, concentric and other geometric shapes. By end-user industry, the market is segmented into construction, energy, transportation, electronics and telecommunications, and other end-user industries.

Copper stranded wire seals are mainly concentrated in China and Southeast Asia. In 2015, China’s copper stranded wire products accounted for about 41.03% of the global market share of copper stranded wire seals, followed by Southeast Asia, accounting for about 16.56%. Market Analysis and Insight: Global Copper Strand market The global copper strand market is valued at $222.3 million in 2020 and is expected to reach $227.1 million by the end of 2026, with a CAGR of 0.3% in 2021-2026. In the medium term, the main factors driving the research market include the growing demand for energy and the development of products with more flexible and functional applications. The loss of energy due to the proximity effect is expected to significantly impede the growth of the market. Increased use of infrastructure, telecommunications, energy and other sectors, as well as activity in emerging economies, are likely to be future opportunities. The Asia-Pacific region is expected to dominate the global market during the forecast period. Key players in the market include Prysmian Group, Nexans, General Cable, Sumitomo Electric, Southwire, SKB Group, FESE, Superior Essex, Poly Cab, Alfanar, Service Wire, Owl Wire & Cable, Pewc, Sarkuysan, ADC, Alan Wire, et al.

The COVID-19 outbreak has severely impacted the entire supply chain in the copper strand market. The copper strand market is expected to grow at a CAGR of 1% over the forecast period (2021-2026). Revenues in the construction industry have fallen sharply. Markets have suffered a lot because of restrictions and blockades in most parts of the world. According to a report by the National Development and Reform Commission (NDRC), construction work resumed in 90 percent of the 11,000 key projects by the end of March 2022. However, shortages of Labour, transport and raw materials remain a problem. The slowdown in construction has played a key role in making demand growth for copper strands in 2022 more difficult to achieve. Construction in the Asia-Pacific region is expected to see a period of negative/low growth over the next two years due to the economic downturn triggered by the current pandemic. In particular, commercial construction in the Asia-Pacific region has been declining sharply under current conditions. America has one of the largest construction industries in the world. Construction investment in the country has been dwindling because of the rapid rise in cases. Construction spending in the country decreased from $1436.73 billion in March 2022 to $136.457 billion in July 2022. In addition, hotel construction is expected to decline 1 percent in 2022 and 0.7 percent in 2023. As copper strand is used to reduce vibration in the structure, the demand for copper strand has decreased. Similarly, demand for copper strands is negatively impacted by other end-user industries such as transportation and electronics. However, with the lifting of the lockdown and the resumption of work in many end-user industries, market growth is expected to resume in 2024.